How to Start Improving Your Credit Score After Payday Loans?

Understanding the Impact of Payday Loans on Your Credit Score

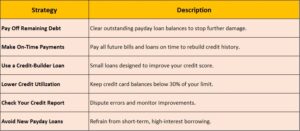

Understanding the impact of payday loans on your credit score is essential for improving your financial health. While payday loans can provide quick cash, they often come with high fees and interest rates, leading to a cycle of debt. If a lender does not report to credit bureaus, taking out a payday loan may not directly affect your score. However, defaulting on the loan can result in collections, severely damaging your credit score. To improving credit score after payday loans, consider these steps:

- Create a budget: Track your income and expenses to find areas to cut back.

- Make timely payments: Pay all your bills, including any remaining payday loans, on time.

- Consider a secured credit card: This can help rebuild your credit by demonstrating responsible credit use.

- Monitor your credit report: Regularly check for errors that could negatively impact your score.

- Seek financial counseling: A professional can offer personalized advice for your situation.

Real-world examples show that individuals who took out multiple payday loans often saw their scores drop. However, by following these steps, they managed to pay off their debts and rebuild their credit over time. They learned to avoid payday loans with bad credit in the future, opting for more sustainable financial solutions. Remember, improving your credit score is a marathon, not a sprint, and every small step counts.

LeandersCashLoan – Simple, Fast Loan Approval!

To improve your credit score after using payday loans, start by assessing your current credit situation. This involves obtaining a free credit report from a major credit bureau, which reveals your credit history, outstanding debts, and any negative marks affecting your score. Look for late payments or high credit utilization, as these are key areas for improvement. Next, analyze the factors that contribute to your credit score. Consider these elements:

- Payment History: Make all payments on time to avoid negative impacts on your score.

- Credit Utilization: Keep credit card balances below 30 percent of your total limit.

- Length of Credit History: Maintain old accounts to benefit from a longer credit history.

- Types of Credit: A diverse mix of credit types can enhance your score.

- New Credit Inquiries: Limit new credit applications, as each inquiry can lower your score temporarily.

With a clear understanding of your credit situation, create a plan to address issues. Set realistic goals, like paying down high-interest debts and making timely payments. Improving your credit score takes time, but with dedication and strategies like consolidating payday loans into lower-interest options, you can save money and enhance your credit score over time.

Creating a Budget to Manage Debt and Improving Credit Score After Payday Loans

Creating a budget is a powerful way to manage debt and improve your credit score after using payday loans. While it may seem overwhelming, breaking it down into simple steps can ease the process. Start by tracking your income and expenses to understand where your money goes each month. You might discover areas to cut back, such as dining out or subscription services, which can free up cash for debt repayment.

Next, prioritize your debts by listing them and focusing on those with the highest interest rates first. This approach, known as the avalanche method, can save you money over time. Set aside a specific amount each month for debt repayment to stay on track and build a saving habit. Remember, even small contributions can accumulate significantly, so consistency is key. Lastly, celebrate your achievements. Acknowledge each time you pay off a debt or adhere to your budget, as this positive reinforcement can motivate you to maintain good financial habits. By creating and sticking to a budget, you can effectively manage your debts and work towards a healthier credit score, even after facing challenges like payday loans with bad credit.

LeandersCashLoan: Fast Funds, No Hidden Fees – Apply Today!

Timely Payments: The Key to Boosting Your Credit Score

Timely payments are essential for improving your credit score, particularly after using payday loans, which can lead to a cycle of debt. Establishing a solid payment history is crucial; on-time payments help you avoid late fees and show lenders that you are a responsible borrower. Over time, this can significantly enhance your credit score and open up better financial opportunities. Here are some key benefits of making timely payments:

- Improved Credit Score: Each on-time payment positively affects your credit history, a major factor in your credit score.

- Lower Interest Rates: A higher credit score can qualify you for loans with lower interest rates, saving you money in the long run.

- Better Loan Options: An improved score makes it easier to secure loans without the high fees associated with payday loans.

To start improving your credit score after payday loans, consider these steps:

- Set Up Automatic Payments: This helps ensure you never miss a due date.

- Create a Budget: Allocate funds specifically for your loan payments to avoid overspending.

- Monitor Your Credit Report: Regularly check for errors that could negatively impact your score.

Also Read: How Do Payday Loans with Bad Credit Work?

How to Dispute Errors on Your Credit Report

To improve your credit score after payday loans, the first step is ensuring your credit report is accurate. Errors can significantly affect your score, especially if you’ve taken out payday loans with bad credit. Disputing these inaccuracies is your right and essential for credit repair.

Start by obtaining a free copy of your credit report from the major credit bureaus at AnnualCreditReport.com. Review it carefully for inaccuracies, such as incorrect personal information, unfamiliar accounts, or late payments that were made on time. If you find an error, follow these steps:

- Document the error: Note the specific mistake and gather supporting documents.

- Contact the credit bureau: Reach out to the bureau reporting the error via online, mail, or phone.

- File a dispute: Clearly explain the error and provide your evidence. The bureau will investigate your claim, typically within 30 days.

- Follow up: After the investigation, you will receive the results. If the error is corrected, your credit score may improve, aiding your recovery from payday loans.

By taking these actions, you can clear up your credit report and work towards a better credit score.

The Importance of Credit Utilization in Score Improvement

Improving your credit score after relying on payday loans hinges on understanding credit utilization. This term refers to the ratio of credit you are using compared to your total available credit. Keeping this ratio low is essential, as it demonstrates to lenders that you manage credit responsibly. Aim to keep your utilization below 30 percent; for instance, if your credit limit is one thousand dollars, maintain a balance under three hundred dollars. This adjustment can significantly enhance your credit score. To improve your credit score after payday loans, consider these steps:

- Pay down existing debts: Prioritize high-interest debts to lower your overall utilization.

- Increase your credit limit: Request a credit limit increase on current accounts to help reduce your utilization ratio without altering your spending habits.

- Avoid new payday loans: Seek alternatives to manage finances without harming your credit further.

- Monitor your credit report: Regularly check for errors that may impact your score.

- Establish a budget: Create a budget to manage expenses and avoid returning to payday loans. Improving your credit score takes time and patience.

By focusing on credit utilization and following these steps, you can gradually rebuild your creditworthiness. Many individuals who actively manage their credit utilization see significant score improvements within months. Take control of your financial future today and watch your credit score rise.

Exploring Credit-Building Loans and Secured Credit Cards

Improving your credit score after relying on payday loans can seem challenging, but there are effective strategies to help you recover. Two promising options are credit-building loans and secured credit cards. These tools not only aid in rebuilding your credit but also foster healthier financial habits. Understanding how they work can empower you to take proactive steps toward a better credit score.

Credit-Building Loans are tailored for those looking to enhance their credit. You borrow a small amount, which is held in a bank account while you make monthly payments. Once paid off, you receive the funds, building your credit history and showcasing your repayment ability. Benefits include:

- Establishing a positive payment history

- Improving your credit utilization ratio

- Accessing funds after repayment

Secured Credit Cards are another great option. You deposit a specific amount as collateral, which becomes your credit limit. Responsible use of a secured card can significantly boost your credit score. Key advantages include:

- Earning rewards or cash back

- Reporting to credit bureaus to help build your score

- Flexibility in managing spending.

By integrating these tools into your financial routine, you can effectively improve your credit score after payday loans and work towards a brighter financial future.

Establishing a Positive Payment History After Payday Loans

Establishing a positive payment history after payday loans is essential for improving your credit score. Many individuals fall into a debt cycle due to high-interest payday loans, but there are effective strategies to rebuild your credit. Start by making timely payments on existing debts, as this demonstrates to lenders that you are responsible with your finances. Payment history is a significant factor in your credit score, so consistency is crucial. To help you establish a positive payment history, consider these practical steps:

- Set up automatic payments to avoid missing due dates.

- Create a budget to manage your income and expenses effectively.

- Consider a secured credit card to build credit responsibly.

- Monitor your credit report regularly to catch and correct any errors that could affect your score.

Real-life examples can inspire you. For instance, Sarah struggled with payday loan payments but turned her situation around by making timely payments and budgeting. Within a year, her credit score improved significantly. By following similar steps, you can also enhance your credit score after payday loans. Remember, this journey requires dedication and the right strategies, but achieving your financial goals is possible.

Utilizing Credit Counseling Services for Guidance

Improving your credit score after relying on payday loans can be challenging, but seeking help from credit counseling services is a smart move. These organizations specialize in navigating the complexities of credit management and can provide personalized advice based on your financial situation. They help you understand how payday loans affect your credit score and guide you on the path to recovery. Utilizing credit counseling services offers several benefits:

- Expert Guidance: Trained professionals provide insights into your credit report and suggest actionable steps to enhance your score.

- Debt Management Plans: Many services assist in creating structured plans to manage and pay off debts, including payday loans.

- Financial Education: You’ll learn about budgeting, saving, and responsible credit use, which can help avoid future financial issues.

To start with credit counseling, follow these steps:

- Research Reputable Agencies: Look for accredited, non-profit credit counseling agencies with positive reviews.

- Schedule a Consultation: Take advantage of free initial consultations to discuss your situation without commitment.

- Follow Their Advice: Stick to the plan you create with your counselor, as consistency is crucial for improving your credit score.

By taking these steps, you can work towards a healthier credit score despite past payday loan challenges.

Long-Term Strategies for Sustaining a Healthy Credit Score

Improving your credit score after relying on payday loans may seem challenging, but with effective strategies, you can work towards a healthier financial future. Your credit score is influenced by factors like payment history, credit utilization, and the length of your credit history. By focusing on these areas, you can gradually rebuild your score and regain financial stability. Here are some long-term strategies to help sustain a healthy credit score:

- Make Timely Payments: Always pay your bills on time. Late payments can significantly harm your credit score. Set reminders or automate payments to avoid missing due dates.

- Reduce Credit Utilization: Keep your credit utilization below 30 percent. For example, if your credit limit is one thousand dollars, maintain a balance under three hundred dollars. Paying down existing debt can improve this ratio.

- Consider a Secured Credit Card: A secured credit card can be beneficial if you have bad credit. It requires a cash deposit as collateral, allowing you to build credit through small purchases and timely payments.

- Regularly Check Your Credit Report: Monitoring your credit report helps identify errors or fraud that could negatively impact your score. You can request a free report annually from major credit bureaus.

By implementing these strategies, you can improve your credit score and maintain a healthy financial profile over time.

FAQs

-

How can I rebuild my credit after using payday loans?

To improve your credit score, pay off outstanding debts, make on-time payments for existing loans, and avoid taking out new payday loans. -

Do payday loans affect my credit score?

Most payday lenders don’t report to major credit bureaus, but defaulting on payments may result in collections, which can lower your score. -

How long does it take to improve my credit after payday loans?

Credit improvement depends on your financial habits. Regular, on-time payments and reducing debt can show positive changes in a few months. -

Should I get a credit card to rebuild my credit after payday loans?

A secured credit card or credit-builder loan can help you improve your score if used responsibly and paid on time. -

What are some alternatives to payday loans to avoid future credit damage?

Consider personal loans, credit unions, borrowing from family, or installment loan options with lower interest rates.

LeandersCashLoan: Apply Now for Same-Day Cash!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Loan!

"*" indicates required fields