How to Avoid Payday Loan Scams for Bad Credit?

Understanding Payday Loan Scams and Their Impact on Bad Credit

Understanding payday loan scams is essential, particularly for individuals with bad credit. These scams target those in urgent need of cash, often promising quick approval and immediate funds. Unfortunately, the reality is often starkly different. Scammers frequently employ aggressive tactics, including hidden fees and unrealistic repayment terms, leading to a damaging cycle of debt that can further harm your credit score. For example, someone might believe a payday loan will resolve their financial troubles, only to find themselves trapped in continuous borrowing and repayment. To protect yourself from these scams, keep these tips in mind:

- Research Lenders: Always verify the lender’s reputation by checking reviews and ratings from past customers.

- Read the Fine Print: Make sure you fully understand all terms and conditions before signing any agreements.

- Watch for Red Flags: Be wary of lenders who guarantee approval regardless of credit history or pressure you to act quickly.

- Seek Alternatives: Consider other options like credit unions or community assistance programs that may provide better terms for those with bad credit.

By remaining informed and cautious, you can safeguard yourself against payday loan scams. Legitimate lenders prioritize transparency and ethical practices, so take the time to explore your options thoroughly before securing a loan. This approach will help you obtain the funds you need without compromising your financial future.

LeandersCashLoan – Simple, Fast Loan Approval!

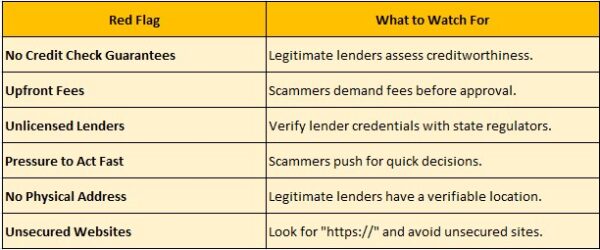

When seeking payday loans, particularly for those with bad credit, vigilance is essential. Scammers often target individuals in urgent need of cash, making it vital to recognize red flags in loan offers. One major warning sign is unsolicited offers. If you receive a loan proposal via email or text from an unfamiliar company, it’s best to avoid it, as legitimate lenders do not typically reach out in this way.

Another red flag is a lack of transparency about fees and interest rates. If a lender is unclear about the total loan cost or pressures you to sign quickly, be cautious. Always request a detailed breakdown of fees and ensure you fully understand the terms. Here are key points to consider when evaluating payday loan offers:

- High-interest rates: Be cautious of excessively high rates.

- No credit checks: Claims of no credit checks often indicate a scam.

- Pressure tactics: If you feel rushed, take a step back.

Lastly, research the lender thoroughly. Look for reviews and check if they are registered with your state’s financial regulatory agency. A legitimate lender will have a physical address and a customer service number. By following these steps, you can avoid loan scams for bad credit and find safe payday loans. Being informed is your best defense against scams.

LeandersCashLoan: Fast Funds, No Hidden Fees – Apply Today!

Researching Lenders to Avoid Scams for Bad Credit

When considering payday loans with bad credit, thorough research is essential to avoid scams. Start by checking online reviews and ratings on platforms like the Better Business Bureau, which can reveal a lender’s reputation. A pattern of complaints is a significant red flag, as legitimate lenders maintain transparency and do not pressure you into hasty decisions. Look for lenders licensed in your state, as each state has specific regulations governing payday loans. This information is typically available on the lender’s website or by direct inquiry.

Additionally, local consumer protection agencies can offer recommendations for trustworthy lenders, providing valuable insights and resources. Always read the fine print before signing any agreement to understand the terms, fees, and repayment schedule. If anything seems suspicious or too good to be true, trust your instincts. Key points to remember include:

- Verify lender credentials and licenses.

- Read reviews and check for complaints.

- Consult consumer protection agencies.

By following these steps, you can navigate payday loans confidently and steer clear of scams, even with bad credit.

Also Read: How Do Payday Loans with Bad Credit Work?

The Importance of Reading Loan Terms Carefully

When considering payday loans, particularly for those with bad credit, understanding the importance of reading loan terms carefully is essential. Many lenders may offer attractive deals, but hidden fees and unfavorable conditions can turn a simple loan into a financial burden. For example, a borrower might see a low-interest rate advertised, only to find that late payment penalties can quickly increase the total amount owed. To avoid falling victim to payday loan scams, scrutinize the fine print. Key aspects to look out for include:

- Interest Rates: Know the annual percentage rate, as some lenders may quote low rates that ultimately increase your costs.

- Fees: Be aware of additional fees, such as application or processing fees.

- Repayment Terms: Understand payment due dates and consequences for missed payments.

- Loan Amounts: Be cautious of lenders offering amounts that seem too good to be true, as they may lead to financial trouble.

Real-world examples highlight these risks. For instance, a borrower named Sarah took out a payday loan without fully understanding the terms and ended up paying more in fees than the original loan amount due to missed payments. By carefully reading loan terms, she could have avoided this situation. Always seek advice or alternatives if something feels off. Being informed is your best defense against scams in the payday loan landscape.

How to Verify the Legitimacy of a Payday Lender

When you’re in a tight spot and considering payday loans with bad credit, it’s crucial to ensure you’re dealing with a legitimate lender. Unfortunately, the urgency of financial distress can make you vulnerable to scams. So, how do you verify the legitimacy of a payday lender? Here are some practical steps to help you navigate this tricky landscape. First, check for licensing. Legitimate payday lenders are required to be licensed in the states they operate. You can usually find this information on their website or by contacting your state’s financial regulatory agency.

Additionally, look for reviews and ratings from other borrowers. Websites like the Better Business Bureau can provide insights into the lender’s reputation. If you see a pattern of complaints, it might be a red flag. Lastly, be wary of lenders who pressure you for personal information upfront or promise guaranteed approval regardless of your credit score. A trustworthy lender will take the time to assess your situation and provide clear terms. Remember, avoiding loan scams for bad credit starts with doing your homework and trusting your instincts. If something feels off, it probably is.

Tips for Finding Safe Alternatives to Payday Loans

When facing financial difficulties, payday loans may appear to be a quick solution, particularly for those with bad credit. However, these loans typically come with exorbitant fees and interest rates, making them a precarious option. To avoid payday loan scams, it is crucial to seek safer alternatives that won’t worsen your financial situation. Here are some effective strategies to consider.

Research Local Credit Unions: Many credit unions provide small personal loans at lower interest rates compared to payday lenders. They often have specific programs for individuals with bad credit. By joining a credit union, you can access these loans and foster a relationship with a supportive financial institution.

Consider Peer-to-Peer Lending: Platforms like LendingClub and Prosper link borrowers with individual investors. These loans can be more cost-effective than payday loans and usually offer more flexible repayment options. Always read the terms carefully to avoid hidden fees.

Explore Community Assistance Programs: Local charities and non-profits frequently offer financial aid or low-interest loans to those in need. Investigate organizations in your area that can provide assistance without the risks associated with payday loans. The aim is to find solutions that enhance your financial health rather than jeopardize it.

Building Your Credit to Avoid High-Interest Loans

Building your credit is essential for avoiding high-interest loans, particularly if you have bad credit. Many individuals consider payday loans as a quick solution, but these often come with steep interest rates and can trap you in a cycle of debt. Instead of resorting to these loans, focus on improving your credit score, which opens up better loan options and helps you avoid scams targeting those with poor credit histories. Here are some effective steps to build your credit and steer clear of payday loan scams:

- Pay your bills on time: This can significantly boost your credit score.

- Keep credit utilization low: Aim to use less than 30 percent of your available credit.

- Check your credit report: Regularly review for errors and dispute inaccuracies.

- Consider secured credit cards: These can help build credit while minimizing risk.

- Avoid unnecessary hard inquiries: Too many applications can hurt your score, so be selective.

By following these steps, you enhance your creditworthiness and reduce the chances of needing high-interest loans. Improving your credit allows you to qualify for personal loans with lower rates, making financial management easier. This proactive approach not only helps you avoid payday loans with bad credit but also shields you from scams targeting vulnerable borrowers. Take control of your financial future today.

Seeking Financial Advice to Navigate Bad Credit

Navigating bad credit can be daunting, especially when looking for loans. Unfortunately, payday loan scams often target those with poor credit, offering quick cash but leading to financial pitfalls. To avoid these scams, seeking financial advice is essential. Experts can help you understand the risks of payday loans and guide you in avoiding predatory lenders. Here are some practical steps to steer clear of payday loan scams:

- Research Lenders: Always check the lender’s reputation through online reviews and ratings.

- Understand the Terms: Read the fine print; if it sounds too good to be true, it likely is.

- Avoid Upfront Fees: Legitimate lenders do not require payment before granting a loan.

- Seek Alternatives: Look into credit unions or community organizations that offer fair loan terms.

- Consult Financial Advisors: They can provide tailored advice to help you make informed decisions.

While payday loans may seem like a quick solution for bad credit, they often lead to a cycle of debt. By seeking financial advice and following these steps, you can protect yourself from scams and find more sustainable financial solutions. Always prioritize your long-term financial health over immediate cash needs.

Reporting Suspected Payday Loan Scams Effectively

Navigating payday loans can be challenging, particularly for those with bad credit. Awareness of potential scams is vital, as many individuals in desperate situations may attract unscrupulous lenders. To protect yourself, knowing how to report suspected payday loan scams is essential. Reporting not only safeguards you but also helps others avoid similar pitfalls. If you suspect a payday loan scam, start by gathering all relevant information, including the lender’s name, contact details, and any documentation received. Then, follow these steps:

- Contact your local consumer protection agency for guidance and potential action against fraudulent lenders.

- File a complaint with the Federal Trade Commission (FTC), which investigates consumer complaints and scams.

- Report to your state’s attorney general, who can enforce state laws against predatory lending practices.

These actions not only assist your situation but also contribute to a broader effort against loan scams. Staying informed is your best defense. Watch for red flags, such as lenders who skip credit checks or pressure you into quick decisions. By being proactive and reporting suspicious activity, you help create a safer lending environment for everyone, especially those seeking payday loans with bad credit. Your vigilance can make a significant difference, so take action when you spot a scam.

FAQs

⭐ What are common signs of a loan scam?

Loan scams often involve:

-

Guaranteed approval without credit checks

-

Upfront fees before loan disbursement

-

Unlicensed lenders

-

High-pressure tactics urging immediate action

-

No physical address or customer support

⭐ How can I verify if a lender is legitimate?

-

Check for licensing with your state’s financial regulator

-

Look for reviews on trusted platforms like the Better Business Bureau (BBB)

-

Verify contact information (real address, working phone number, official email)

-

Read the loan terms carefully before signing anything

⭐ Are upfront fees a red flag?

Yes. Legitimate lenders typically deduct fees from the loan amount rather than asking for upfront payments. Be wary of requests for wire transfers or gift card payments.

⭐ Can scammers impersonate real lenders?

Yes. Fraudsters may use fake websites, emails, or phone calls to mimic real lenders. Always contact the lender directly using official details found on their verified website.

⭐ What should I do if I suspect a loan scam?

-

Stop communication immediately

-

Report the scam to the Federal Trade Commission (FTC) or your state’s Attorney General

-

Monitor your credit report for any fraudulent activity

LeandersCashLoan: Apply Now for Same-Day Cash!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Loan!

"*" indicates required fields