Short Term Loan Lenders Explained for Financial Urgencies

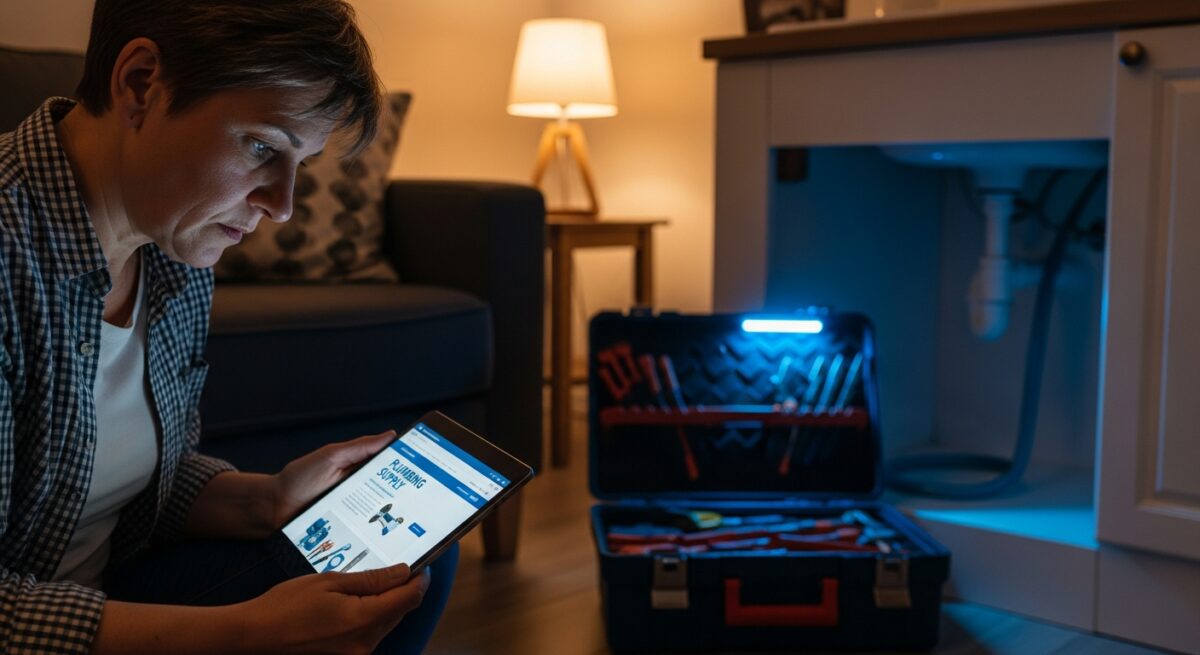

Just like a sudden pipe burst or a failing furnace, a financial emergency can happen to any homeowner without warning. When an urgent expense pops up before your next paycheck, it can leave you feeling stressed and searching for a quick solution. Short term loan lenders are financial service providers designed to offer a rapid cash injection for these exact moments, but understanding how they work is key to using them wisely.

To responsibly explore your emergency loan options and get fast answers, visit Get Emergency Funds.

What Are Short Term Loan Lenders?

Short term loan lenders are companies that provide small, fast loans meant to be repaid over a brief period, typically within a few weeks to a few months. Think of them as a financial tool for a specific, immediate need, much like calling a plumber for a leak you can’t fix yourself. They are not designed for long-term financing but to bridge a temporary cash gap.

These lenders operate both online and from physical storefronts, offering products like payday loans or installment loans. The process is usually much faster than a traditional bank loan, with funds often available the same or next business day, which is their primary appeal during a cash crisis.

Direct Lenders vs. Broker Services

It’s important to know who you’re dealing with. A direct lender is the company that provides the loan funds and sets your terms. A broker or connecting service acts as a middleman, passing your application to multiple potential lenders. Working with a direct lender often means clearer communication about your loan’s exact terms.

Why It Matters for Homeowners

For homeowners, unexpected costs aren’t just inconvenient—they can threaten your home’s safety and your family’s comfort. A broken water heater, a critical roof repair before a storm, or an urgent HVAC fix in extreme weather can’t always wait. Short term loans can provide the funds to address these issues immediately, preventing minor damage from becoming a major, more expensive disaster.

Using these loans responsibly means accessing funds for a true emergency, repaying it promptly, and then moving on. The benefit is the ability to solve a pressing problem without delay, protecting your largest investment: your home. However, it’s crucial to understand the costs, which are typically higher than traditional financing, and to have a solid plan for repayment.

Common Issues and Their Causes

The most common issues borrowers face with short term loans stem from misunderstanding the terms or using them for the wrong reasons. A cycle of debt can begin if a loan is used for a non-urgent expense, making it hard to repay on time and leading to rollovers or new loans to cover the old one.

High costs are another frequent concern. The fees and interest rates (often expressed as an APR) on short term loans are higher than those on credit cards or bank loans. This is because the lender is taking a risk by lending quickly with minimal credit checks. Not reading the agreement carefully can lead to surprises about the total repayment amount.

- Rollover Traps: Needing to extend the loan, which adds new fees.

- Budget Strain: The large single repayment can disrupt your next month’s finances.

- Unclear Terms: Not fully understanding the fees, due date, or what happens if you can’t pay.

How Professionals Fix the Problem

Reputable short term loan lenders operate like skilled tradespeople: they diagnose your specific need, present a clear plan (loan agreement), and provide the solution (funds) efficiently. A good lender’s process is transparent and follows state regulations designed to protect you.

- Clear Assessment: They will clearly state the loan amount, finance charge, APR, due date, and total repayment amount before you agree.

- Regulated Process: They adhere to state laws that may cap fees, limit loan amounts, or offer extended repayment plans.

- Responsible Lending: They should evaluate your ability to repay the loan, not just approve everyone. For more insight on loans for those with credit challenges, you can review our resource on finding lenders for bad credit.

This professional approach turns a high-cost product into a manageable, one-time tool for a genuine emergency.

Signs You Should Not Ignore

Just as you wouldn’t ignore a leaking ceiling, there are clear warning signs that a short term loan lender may not be operating in your best interest. Recognizing these red flags can protect you from predatory practices and unmanageable debt.

A major warning sign is a lender who doesn’t clearly disclose all fees and the Annual Percentage Rate (APR). If the costs seem vague or you’re pressured to sign before reading, step back. Similarly, lenders who don’t ask about your income or ability to repay are not acting responsibly.

To responsibly explore your emergency loan options and get fast answers, visit Get Emergency Funds.

- No clear APR or fee disclosure.

- Pressure to borrow more than you need.

- Guaranteed approval without any checks.

- The lender is not licensed in your state.

- Requests for upfront fees before funding.

Cost Factors and What Affects Pricing

The cost of a short term loan isn’t a flat rate; it varies based on several factors. The primary driver is the state you live in, as each state has its own laws regulating maximum fees, interest rates, and loan amounts. For example, rules differ significantly if you’re looking at options in California versus other states.

The loan amount and term length directly impact the finance charge. A larger loan or a longer term (if it’s an installment loan) will typically cost more in total fees. Your creditworthiness may also play a role, though these lenders primarily focus on your current income and ability to repay the specific loan on time.

How To Choose the Right Professional or Service

Selecting a reputable short term lender is as important as choosing a qualified contractor for your home. Start by verifying the lender is licensed to operate in your state. Your state’s financial regulator or attorney general’s website can usually provide this information.

Next, read reviews and compare terms. Look for lenders who are transparent about all costs and who answer your questions patiently. Choose a direct lender for clearer accountability, and always read the entire loan agreement before signing. Ensure you understand the repayment schedule and the consequences of a missed payment.

Long-Term Benefits for Your Home

When used correctly for a true emergency, a short term loan can provide long-term benefits for your home’s health and your financial stability. Addressing a critical repair immediately prevents more extensive and costly damage down the road. Paying a utility bill on time with a short-term bridge loan avoids disconnect fees and service interruptions.

This responsible use protects your home’s value, maintains your family’s comfort and safety, and allows you to manage your cash flow without derailing your broader financial picture. The key is viewing it as a specific tool for a specific job, not a recurring source of funds.

Frequently Asked Questions

How fast can I get money from a short term loan lender?

If approved, funding can be very fast. With online lenders, you may see funds deposited into your bank account as soon as the next business day, sometimes even the same day. Physical storefronts may provide cash or a check on the spot.

What do I need to qualify for a short term loan?

Requirements are typically simpler than for bank loans. You’ll generally need proof of identity, an active checking account, proof of steady income (like pay stubs), and to be at least 18 years old. Specifics can vary by lender and state.

Will a short term loan affect my credit score?

It can. Many lenders don’t require a hard credit check for approval, but some may report repayment activity to credit bureaus. Timely repayment could help build credit, while late or missed payments can significantly harm your score.

What is the difference between a payday loan and an installment loan?

A payday loan is usually due in full on your next payday, as one lump sum. An installment loan is repaid over a set period in multiple, scheduled payments. Understanding payday loan repayment terms is essential before you borrow.

What happens if I can’t repay my loan on time?

Contact your lender immediately. Many states require lenders to offer an extended repayment plan. Rolling over the loan (taking a new loan to pay the old one) adds fees and can lead to a cycle of debt. It’s critical to communicate and know your rights.

Are online short term loan lenders safe?

Reputable online lenders use secure, encrypted websites to protect your data (look for “https” in the URL). Always verify the lender’s physical address and phone number, and check for state licensing to ensure they are legitimate.

Short term loan lenders are a specific financial tool for urgent situations. By understanding how they work, recognizing the costs, and choosing a reputable provider, you can navigate a cash flow emergency effectively and protect your home and budget from larger problems. The goal is to solve the immediate issue and return to stable financial ground as quickly as possible.

To responsibly explore your emergency loan options and get fast answers, visit Get Emergency Funds.

Find a Loan!

"*" indicates required fields