What Are the Benefits of a Bison Cash Loan?

When unexpected expenses arise, knowing your options is essential. A bison cash loan can provide quick financial support. But what are the benefits of this loan? Let’s explore the basics.

Quick Access to Funds

One major advantage of a bison cash loan is the rapid access to funds. Unlike traditional loans that can take days or weeks, a bison cash loan can often be approved and funded within hours. This is particularly helpful for emergencies like car repairs or medical bills.

Flexible Repayment Options

Another benefit is the flexibility in repayment. Many lenders offer various terms, allowing you to select a plan that suits your budget. This makes repayment less stressful compared to other financial options.

Easy Application Process

Applying for a bison cash loan is usually straightforward. You can often complete the process online, such as through Cash 1 online, making it convenient. Just fill out a simple form, and you could have cash in hand quickly!

LeandersCashLoan – Simple, Fast Loan Approval!

What Makes Bison Cash Loans Unique?

When unexpected expenses arise, knowing your options can make all the difference. Bison cash loans offer unique benefits that can help you navigate financial challenges with ease. Understanding these advantages can empower you to make informed decisions when you need quick cash.

Quick Approval Process

One of the standout features of a bison cash loan is the fast approval process. Unlike traditional loans, you can often get approved within hours, allowing you to access funds when you need them most. This is especially helpful for emergencies or urgent bills.

Flexible Repayment Options

Bison cash loans also come with flexible repayment options. You can choose a plan that fits your budget, making it easier to manage your finances. This flexibility can reduce stress and help you avoid late fees.

Accessible Online Services

With services like Cash 1 online, applying for a bison cash loan is simple and convenient. You can complete the entire process from the comfort of your home, saving you time and effort. This accessibility is a game-changer for many borrowers.

LeandersCashLoan: Fast Funds, No Hidden Fees – Apply Today!

How Can a Bison Cash Loan Improve Your Financial Flexibility?

When unexpected expenses arise, having financial flexibility is crucial. A bison cash loan can be a helpful tool to manage those situations. Understanding the benefits of this type of loan can empower you to make informed decisions about your finances.

Quick Access to Funds

One of the biggest advantages of a bison cash loan is the quick access to funds. Whether it’s a medical bill or a car repair, you can get cash fast, often through platforms like cash 1 online. This means you won’t have to wait long to cover urgent expenses.

Easy Application Process

Applying for a bison cash loan is typically straightforward. Most lenders offer online applications, making it easy to apply from the comfort of your home. This convenience can save you time and reduce stress when you need money quickly.

Are Bison Cash Loans a Good Option for Emergency Expenses?

When unexpected expenses arise, knowing your options can make a big difference. A bison cash loan can be a helpful solution for those urgent financial needs. But are these loans really a good choice for emergencies? Let’s explore the benefits together!

Quick Access to Funds

One of the main advantages of a bison cash loan is the speed at which you can receive funds. Unlike traditional loans, which can take days or weeks, cash 1 online loans often provide money within hours. This means you can tackle your emergency expenses without delay!

Flexible Repayment Options

Another benefit is the flexibility in repayment. Bison cash loans typically offer various repayment plans, allowing you to choose what works best for your budget. This flexibility can ease the stress of managing unexpected costs, making it easier to get back on track.

The Application Process: How to Secure a Bison Cash Loan

Understanding the application process for a bison cash loan is essential for quick financial relief. Knowing how to secure one effectively can ease your worries. Here are the steps to get your cash 1 online:

Steps to Apply for a Bison Cash Loan

- Research Your Options: Explore different lenders, comparing terms, interest rates, and customer reviews to find the best fit.

- Gather Necessary Documents: Prepare your identification and proof of income to speed up the process.

- Fill Out the Application: Most lenders allow online applications. Complete the form accurately to avoid delays.

Benefits of a Bison Cash Loan

- Quick Access to Funds: Receive your money quickly, often within a day.

- Flexible Repayment Options: Various repayment plans help you manage your budget.

- No Credit Check: Some loans don’t require a credit check, making them accessible to more people.

Comparing Bison Cash Loans to Traditional Lending Options

When borrowing money, it’s essential to understand your options. A bison cash loan stands out as a great alternative to traditional lending methods. Let’s explore the benefits of choosing a bison cash loan over conventional loans.

Quick Access to Funds

One major advantage of a bison cash loan is the quick access to funds. Unlike traditional banks that may take days to process applications, a bison cash loan can provide cash within hours, making it ideal for emergencies.

Flexible Repayment Options

Bison cash loans also offer flexible repayment terms. You can select a plan that fits your budget, simplifying financial management. In contrast, traditional loans often have strict repayment schedules that can be challenging to maintain.

Less Stringent Requirements

Additionally, bison cash loans have less stringent approval requirements. While cash 1 online loans may involve extensive credit checks, bison cash loans focus more on your current financial situation, allowing more people to qualify, even with less-than-perfect credit.

What Are the Potential Risks of a Bison Cash Loan?

When considering a bison cash loan, it’s essential to weigh the benefits against potential risks. Understanding these risks can help you make informed decisions about your financial future. Let’s dive into what you should know before applying for a bison cash loan.

High Interest Rates

One of the main risks of a bison cash loan is the high interest rates. These loans often come with fees that can add up quickly. If you’re not careful, you might end up paying back much more than you borrowed.

Short Repayment Terms

Another concern is the short repayment terms. Many bison cash loans require repayment within a few weeks or months. This can be challenging if you’re not prepared, potentially leading to missed payments and additional fees.

Impact on Credit Score

Lastly, taking out a bison cash loan can affect your credit score. If you struggle to repay on time, it could hurt your credit rating. This might make it harder to secure loans in the future, including options like cash 1 online. Always think ahead before borrowing!

Customer Experiences: Real Stories with Bison Cash Loans

When it comes to managing unexpected expenses, many people find themselves in a tight spot. That’s where a bison cash loan can come in handy. These loans are designed to provide quick financial relief, making them a popular choice for those in need of immediate cash. But what do real customers think about their experiences with bison cash loans? Let’s dive into some stories that highlight the benefits.

Quick Access to Funds

One of the most significant advantages of a bison cash loan is the speed of approval. Customers often share how easy it was to apply online. With cash 1 online, they received funds in their accounts within hours, allowing them to tackle urgent bills or unexpected repairs without delay.

Flexible Repayment Options

Another benefit that many borrowers appreciate is the flexibility in repayment. Customers have noted that bison cash loans come with manageable terms. This means they can pay back the loan in a way that fits their budget, reducing stress and making it easier to stay on track financially.

How ‘LendersCashLoan.com’ Can Help You Navigate Bison Cash Loans

When unexpected expenses arise, understanding the benefits of a bison cash loan can be a game-changer. These loans provide quick access to cash, helping you manage financial surprises without stress. Knowing how to navigate these options is essential for making informed decisions.

Quick Access to Funds

- Speedy Approval: Bison cash loans often have a fast approval process, meaning you can get the money you need in no time.

- Convenience: With platforms like Cash 1 online, applying for a loan is as easy as a few clicks, making it accessible for everyone.

Flexible Repayment Options

- Tailored Plans: Many lenders offer flexible repayment plans, allowing you to choose what works best for your budget.

- Manageable Payments: This flexibility helps ensure that you can repay the loan without straining your finances.

With the right guidance, like that from ‘LendersCashLoan.com’, navigating the world of bison cash loans can be straightforward. By understanding the benefits and options available, you can make choices that support your financial well-being.

Maximizing the Benefits of Your Bison Cash Loan

When life throws unexpected expenses your way, a bison cash loan can be a lifesaver. Understanding the benefits of this type of loan is crucial, especially if you need quick cash to cover bills or emergencies. Let’s explore how a bison cash loan can help you regain control of your finances.

Quick Access to Funds

One of the biggest advantages of a bison cash loan is the speed at which you can receive funds. Unlike traditional loans that may take days or weeks, a bison cash loan offers quick approval and access to cash, often within 24 hours. This is especially helpful for urgent needs, like car repairs or medical bills.

Flexible Repayment Options

Bison cash loans often come with flexible repayment plans. This means you can choose a schedule that fits your budget, making it easier to manage your payments. Plus, with options available through platforms like Cash 1 online, you can find terms that work for you without added stress.

FAQs

💰 What is a Bison Cash Loan?

A Bison Cash Loan typically refers to personal or small business funding offered through entities like Bison Green Loans or Bison Mercantile. These lenders provide financial solutions for various short-term or business-related needs.

⚖️ Are Bison Cash Loans considered tribal loans?

Yes, some Bison Cash Loan providers operate as tribal lenders, which means they are governed by tribal law rather than state law. This can offer more flexible loan options but may come with different regulatory protections.

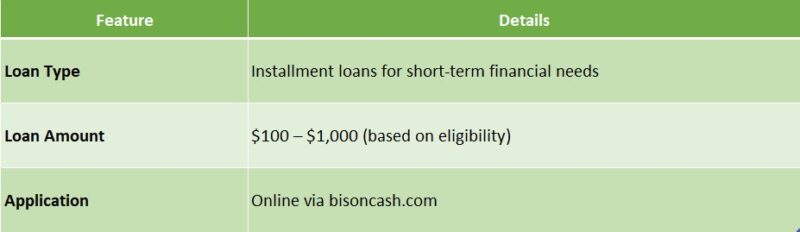

🛡️ What are the typical loan amounts and terms offered?

Loan amounts and terms vary depending on the provider and your qualifications. Bison lenders may offer personal loans or business loans, with repayment terms and interest rates that differ based on your application.

🔍 How quickly can I receive funds after approval?

Many Bison Cash Loan providers aim to fund loans within one business day after approval, though it can take longer depending on the lender and your bank’s processing times.

🚫 Are there any risks associated with Bison Cash Loans?

Yes, tribal loans may carry higher interest rates and fewer consumer protections than state-regulated loans. Always review the loan agreement carefully and be sure you can meet the repayment schedule.

LeandersCashLoan: Apply Now for Same-Day Cash!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Loan!

"*" indicates required fields