How to Apply for Cash Central Installment Loans?

Understanding how to apply for cash central installment loans is crucial for anyone needing financial assistance. These loans can help you manage unexpected expenses or consolidate debt. But before diving in, it’s important to know the steps involved in the application process.

Steps to Apply for Cash Central Installment Loans

- Visit the Cash Central Website: Start by going to the cash 1 online platform. Here, you can find all the information you need about their installment loans.

- Fill Out the Application: Complete the online application form. Make sure to provide accurate information about your income and expenses.

- Submit Required Documents: You may need to upload documents like your ID, proof of income, and bank statements. This helps Cash Central verify your information.

- Review Loan Terms: Once approved, carefully read the loan terms. Understand the interest rates and repayment schedule before accepting the loan.

- Receive Your Funds: After acceptance, the funds are usually deposited directly into your bank account. This can happen quickly, sometimes within one business day!

Benefits of Cash Central Installment Loans

- Flexible Repayment Options: You can choose a repayment plan that fits your budget.

- Quick Access to Funds: Ideal for emergencies or urgent needs.

- Build Your Credit: Making timely payments can improve your credit score.

LeandersCashLoan – Simple, Fast Loan Approval!

Who Can Qualify for Cash Central Installment Loans?

When facing financial challenges, knowing how to apply for cash central installment loans can be a lifesaver. These loans help manage unexpected expenses like car repairs or medical bills without causing financial strain. Let’s look at who qualifies for these loans.

To qualify for cash central installment loans, you need to meet a few basic requirements:

- Age: You must be at least 18 years old.

- Income: A steady income source is essential, whether from a job, benefits, or cash 1 online income.

- Residency: You should reside in the state where you’re applying for the loan.

- Bank Account: An active checking account is usually necessary for loan disbursement.

Meeting these criteria can lead to financial relief, as cash central installment loans are designed to be accessible.

Additional Considerations

While the basic requirements are clear, consider these additional factors:

- Credit History: A good credit score can enhance your chances, but it’s not always required.

- Loan Amount: Think about how much you need and what you can realistically repay.

- Repayment Terms: Understand the repayment schedule to manage your budget effectively.

How to Start the Application Process

To apply, follow these steps:

- Visit the Website: Go to the cash central website or cash 1 online platform.

- Fill Out the Application: Provide accurate personal and financial information.

- Submit Your Application: After completing the application, submit it and await approval.

LeandersCashLoan: Fast Funds, No Hidden Fees – Apply Today!

Step-by-Step Guide to Applying for Cash Central Installment Loans

Applying for cash central installment loans can seem daunting, but it doesn’t have to be! Understanding the steps involved can make the process smoother and less stressful. Whether you need funds for an unexpected expense or a planned purchase, knowing how to apply is crucial.

1. Gather Your Information

Before you start the application, collect necessary documents. You’ll need:

- Proof of income

- Identification (like a driver’s license)

- Bank account details

This information helps speed up the process and ensures you meet the eligibility requirements.

2. Visit the Cash 1 Online Website

Next, head over to the Cash 1 online platform. It’s user-friendly and designed to guide you through the application. Look for the installment loans section and click on it to get started.

3. Fill Out the Application Form

Now, fill out the online application form. Be honest and accurate with your information. This step is crucial because it determines your loan amount and terms. Once completed, review your details before submitting.

4. Wait for Approval

After submitting, you’ll wait for a response. Cash Central usually provides quick feedback, so keep an eye on your email or phone for updates. If approved, you’ll receive details about your loan terms.

Also Read: How to Apply for Cash 1 Online Loans?

What Documents Are Required for Your Cash Central Application?

When you’re in a tight spot financially, knowing how to apply for cash central installment loans can be a lifesaver. These loans can help you manage unexpected expenses, but you need the right documents to get started. Let’s dive into what you need to gather for your application.

To apply for cash central installment loans, you’ll need a few key documents. Having these ready will make the process smoother and faster. Here’s what you should prepare:

Essential Documents:

- Proof of Identity: A government-issued ID like a driver’s license or passport. This shows who you are.

- Income Verification: Recent pay stubs or bank statements to prove you have a steady income. This helps lenders see you can repay the loan.

- Social Security Number: This is needed for identification and verification purposes.

- Contact Information: Make sure to provide a valid phone number and email address so lenders can reach you easily.

Gathering these documents is crucial for a successful application. Once you have everything in order, you can apply for cash 1 online, making the process even more convenient. Remember, being prepared can save you time and stress!

How to Improve Your Chances of Approval for Cash Central Installment Loans?

Applying for cash central installment loans can be a straightforward process, but knowing how to improve your chances of approval is essential. Whether you need funds for unexpected expenses or to consolidate debt, understanding the application process can make a big difference. Let’s explore some effective strategies to boost your approval odds!

Understand Your Financial Situation

Before applying, take a close look at your finances. Knowing your income, expenses, and credit score can help you determine how much you can afford to borrow. This clarity will not only guide your application but also show lenders that you are responsible with money.

Gather Necessary Documents

Having the right documents ready can speed up your application process. Here’s what you might need:

- Proof of income (like pay stubs)

- Bank statements

- Identification (like a driver’s license)

These documents help cash 1 online verify your information and assess your eligibility for cash central installment loans.

Maintain a Good Credit Score

A higher credit score can significantly improve your chances of getting approved. If your score is low, consider taking steps to boost it before applying. Pay off small debts, make payments on time, and avoid taking on new debt. This proactive approach can make a big difference in your loan application.

Exploring the Benefits of Cash Central Installment Loans

When unexpected expenses arise, knowing how to apply for cash central installment loans can be a lifesaver. These loans offer a flexible way to manage your finances, allowing you to pay back over time instead of all at once. Let’s dive into the benefits and the application process!

Why Choose Cash Central Installment Loans?

Cash central installment loans provide several advantages that make them appealing. Here are a few reasons why you might consider them:

- Flexible Repayment: You can choose a repayment plan that fits your budget.

- Quick Access to Funds: Cash 1 online makes it easy to apply and receive money quickly.

- Build Your Credit: Timely payments can help improve your credit score.

How to Apply for Cash Central Installment Loans

Applying for cash central installment loans is straightforward. Here’s how you can get started:

- Visit the Website: Go to the Cash Central website.

- Fill Out the Application: Provide your personal and financial information.

- Submit Your Application: Click submit and wait for approval.

- Receive Your Funds: Once approved, the money can be deposited into your account quickly.

By following these steps, you can easily navigate the process and secure the funds you need.

How LendersCashLoan.com Can Help You Navigate the Cash Central Application Process

Applying for cash central installment loans can feel overwhelming, but it doesn’t have to be! Understanding the application process is crucial for anyone looking to secure funds quickly and easily. With the right guidance, you can navigate this journey with confidence and clarity.

Step-by-Step Guidance

At LendersCashLoan.com, we break down the application process into simple steps. Here’s how you can apply for cash central installment loans:

- Visit the Cash Central Website: Start by going to the Cash Central website to find detailed information about their loan offerings.

- Fill Out the Application: Complete the online application form. Make sure to provide accurate information to avoid delays.

- Submit Required Documents: You may need to upload documents like proof of income or identification.

- Review Your Loan Options: Once approved, review the terms and choose the best option for your needs.

- Receive Your Funds: After acceptance, funds can be deposited into your account quickly, often within one business day!

Why Choose Cash Central?

Cash Central offers flexibility with their installment loans, allowing you to repay over time. This means lower monthly payments compared to traditional loans. Plus, with cash 1 online, you can manage your loan from the comfort of your home, making it super convenient!

FAQs

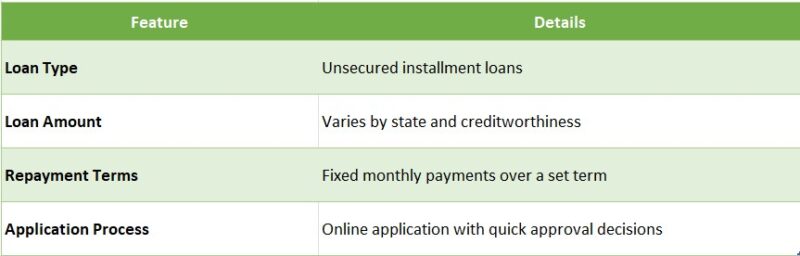

💰 What is a Cash Central installment loan?

A Cash Central installment loan is a personal loan that provides a lump sum of money, repaid in regular scheduled payments over several months.

📄 What are the requirements to apply?

To apply, you need a verifiable source of income, a valid checking account in your name, a working phone number, your Social Security Number, and to be at least 18 years old (19 in some states).

🌐 In which states are Cash Central installment loans available?

Cash Central installment loans are available in select states including Alabama, Delaware, Idaho, Missouri, South Carolina, Utah, and Wisconsin.

🏦 How much can I borrow, and what are the repayment terms?

You can typically borrow between $300 and $5,000, with repayment terms ranging from 6 to 24 months depending on your pay frequency and loan agreement.

⚠️ What are the interest rates and fees?

Interest rates vary by state but are generally high, often ranging from 180% to 360% APR. Origination and late fees may also apply.

LeandersCashLoan: Apply Now for Same-Day Cash!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Loan!

"*" indicates required fields