Payday Loans Online in Massachusetts: Your Best Options

When unexpected expenses arise, many people in Massachusetts turn to payday loans online. These loans can be a quick solution for urgent financial needs, but it’s essential to understand how they work before diving in. Knowing your options can make a significant difference in your financial health.

What Are Payday Loans?

Payday loans are short-term loans designed to cover urgent expenses until your next paycheck. They are typically easy to apply for and can be accessed online, making them a convenient choice for many. However, they often come with high interest rates, so it’s crucial to borrow wisely.

Key Benefits of Online Payday Loans

- Quick Access: You can apply from the comfort of your home.

- Fast Approval: Many lenders provide instant decisions.

- Flexible Amounts: Borrow what you need, often between $100 and $1,000.

Before applying for payday loans online in Massachusetts, consider your repayment plan. Make sure you can pay back the loan on time to avoid additional fees. Always read the terms carefully and choose a reputable lender to ensure a smooth borrowing experience.

LeandersCashLoan – Simple, Fast Loan Approval!

Are Payday Loans Online in Massachusetts Right for You?

When unexpected expenses arise, many people in Massachusetts turn to payday loans online for quick financial relief. Understanding your options can make a significant difference in your financial journey. But are payday loans online in Massachusetts the right choice for you? Let’s explore this together!

Understanding Payday Loans Online in Massachusetts

Payday loans online are short-term loans designed to help you cover immediate expenses until your next paycheck. They can be a lifesaver for urgent needs like medical bills or car repairs. However, it’s essential to weigh the pros and cons before diving in.

Key Considerations

- Interest Rates: Online payday loans often come with high-interest rates. Make sure you can afford the repayment.

- Loan Amounts: These loans typically range from $100 to $1,000. Determine how much you really need.

- Repayment Terms: Understand when and how you will repay the loan. Missing payments can lead to additional fees.

In conclusion, payday loans online in Massachusetts can be a helpful tool in a financial pinch. However, they should be approached with caution. Always consider your ability to repay and explore other options if possible.

LeandersCashLoan: Fast Funds, No Hidden Fees – Apply Today!

Exploring the Benefits of Online Payday Loans in Massachusetts

When unexpected expenses arise, many people in Massachusetts find themselves in need of quick cash. This is where payday loans online in Massachusetts come into play. They offer a fast and convenient solution for those who need money urgently, making them a popular choice for many.

Quick Access to Funds

One of the biggest advantages of online payday loans is the speed at which you can access funds. Unlike traditional loans, which can take days or even weeks to process, online payday loans can often be approved within minutes. This means you can get the cash you need almost instantly, helping you tackle emergencies without delay.

Easy Application Process

Applying for payday loans online in Massachusetts is straightforward. You can complete the entire process from the comfort of your home. Most lenders require minimal documentation, and you can fill out the application on your smartphone or computer. This convenience is a game-changer for many borrowers.

Flexible Repayment Options

Many online payday lenders offer flexible repayment plans. This means you can choose a repayment schedule that works best for your financial situation. Whether you prefer to pay back the loan quickly or need a bit more time, there are options available to suit your needs.

How to Apply for Payday Loans Online in Massachusetts: A Step-by-Step Guide

Applying for payday loans online in Massachusetts can be a straightforward process, especially when you know what to expect. These loans can provide quick cash for unexpected expenses, making them a popular choice for many. Let’s walk through the steps to help you secure your funds efficiently.

Step 1: Research Lenders

Before you apply, take some time to research different lenders offering payday loans online in Massachusetts. Look for reviews and compare interest rates. This will help you find the best option that suits your needs.

Step 2: Gather Your Information

You’ll need to have some personal information ready. This includes your name, address, income details, and bank account information. Having everything organized will make the application process smoother.

Step 3: Complete the Application

Most lenders have a simple online application form. Fill it out with accurate information. Double-check for any errors before submitting. This step is crucial to avoid delays in processing your loan.

Step 4: Review Loan Terms

Once approved, carefully review the loan terms. Pay attention to the interest rates and repayment schedule. Make sure you understand what you’re agreeing to before accepting the loan.

Step 5: Receive Your Funds

If everything looks good, you’ll receive your funds quickly, often within one business day. This is one of the major benefits of online payday loans—they’re fast and convenient!

What to Consider Before Taking Out a Payday Loan Online in Massachusetts

When considering payday loans online in Massachusetts, it’s essential to know what you’re getting into. These loans can be a quick fix for urgent financial needs, but they come with responsibilities. Understanding your options can help you make the best choice for your situation.

Key Considerations Before Applying

- Interest Rates: Payday loans often have high-interest rates. Make sure you know what you’ll be paying back.

- Loan Amount: Determine how much money you actually need. Borrowing too much can lead to more debt.

- Repayment Terms: Understand when and how you’ll need to repay the loan. Missing payments can lead to additional fees.

- Lender Reputation: Research lenders to ensure they are trustworthy. Look for reviews and ratings from other borrowers.

Benefits of Online Payday Loans

- Convenience: You can apply from home without needing to visit a physical location.

- Quick Approval: Many online lenders offer fast approvals, sometimes within minutes.

- Accessibility: Online payday loans are often available to those with less-than-perfect credit.

By considering these factors, you can navigate the world of payday loans online in Massachusetts more confidently. Remember, it’s crucial to borrow responsibly and only what you can afford to repay.

Comparing Lenders: Finding the Best Payday Loans Online in Massachusetts

When life throws unexpected expenses your way, payday loans online in Massachusetts can be a quick solution. Understanding your options is crucial, as it helps you make informed decisions and avoid pitfalls. Let’s explore how to compare lenders and find the best payday loans online that suit your needs.

Key Factors to Consider

- Interest Rates: Different lenders offer varying rates. Lower rates mean less money paid back.

- Repayment Terms: Check how long you have to repay the loan. Longer terms can ease financial pressure.

- Customer Reviews: Look for feedback from other borrowers. Positive reviews often indicate reliable lenders.

Steps to Compare Lenders

- Research: Start by searching for payday loans online in Massachusetts. Make a list of potential lenders.

- Compare Rates: Use online tools to compare interest rates and fees.

- Read the Fine Print: Understand the terms before signing anything. Transparency is key!

- Ask Questions: Don’t hesitate to reach out to lenders for clarification. A good lender will be happy to help.

How LendersCashLoan.com Can Help You Secure the Best Payday Loan Options

When unexpected expenses arise, finding the right financial solution can feel overwhelming. That’s where payday loans online in Massachusetts come into play. They offer quick access to cash, helping you manage urgent bills or emergencies without the long wait of traditional loans.

At LendersCashLoan.com, we understand that navigating the world of online payday loans can be tricky. Our goal is to simplify the process for you. Here’s how we can assist:

Easy Comparisons

- Find the Best Rates: We provide a side-by-side comparison of various lenders, ensuring you get the best deal possible.

- User-Friendly Interface: Our website is designed to make your search easy and stress-free. You can quickly filter options based on your needs.

Expert Guidance

- Helpful Resources: We offer articles and tips to help you understand the ins and outs of payday loans online in Massachusetts.

- Customer Support: Our team is here to answer your questions and guide you through the application process, making it as smooth as possible.

Alternatives to Payday Loans Online in Massachusetts: What Are Your Options?

When you’re in a tight spot financially, payday loans online in Massachusetts might seem like the quickest solution. However, they often come with high fees and interest rates. Luckily, there are alternatives that can help you manage your money without falling into a debt trap. Let’s explore these options together!

Credit Unions and Local Banks

Credit unions and local banks often offer small personal loans with lower interest rates than payday loans online in Massachusetts. They may also provide flexible repayment terms, making it easier for you to pay back what you borrow. Plus, being a member of a credit union can give you access to financial education resources!

Payment Plans

If you’re facing a temporary cash crunch, consider talking to your service providers. Many companies offer payment plans that allow you to spread out your payments over time. This can help you avoid the high costs associated with online payday loans while keeping your services active.

Borrowing from Friends or Family

Sometimes, the best option is right in front of you. Borrowing from friends or family can be a great way to get the money you need without the stress of high interest rates. Just make sure to communicate clearly about repayment to keep your relationships strong.

FAQs

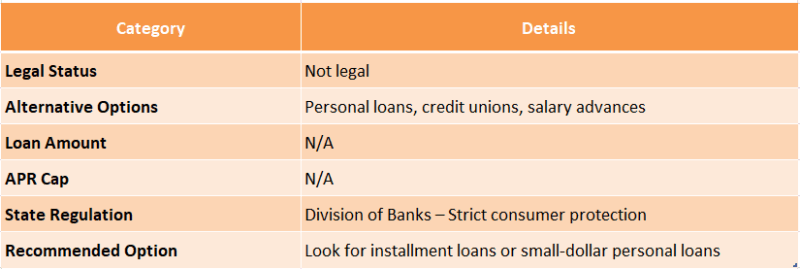

⚖️ Are payday loans legal in Massachusetts?

No, traditional payday loans are effectively banned in Massachusetts due to strict APR caps (maximum 23% on small loans), which make high-interest payday lending illegal.

🌐 Can I get a payday loan online in Massachusetts?

While some online lenders may offer loans to Massachusetts residents, many are unlicensed and illegal under state law. It’s important to verify a lender’s license before borrowing.

🔍 What are safe alternatives to payday loans in Massachusetts?

Consider credit union small-dollar loans, personal loans from banks, or state assistance programs that offer lower rates and legal protection for borrowers.

💳 What happens if I take a payday loan from an unlicensed lender?

You may face excessive fees, aggressive collection practices, and lack of legal recourse. It’s best to report unlicensed lenders to the Massachusetts Division of Banks.

✅ How can I find a legal short-term loan in Massachusetts?

Check the Division of Banks website for a list of licensed lenders, or explore installment loans and emergency financial aid from reputable institutions like credit unions or local nonprofits.

LeandersCashLoan: Apply Now for Same-Day Cash!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Loan!

"*" indicates required fields