Online Payday Loans: How to Apply for Fast Cash

Online payday loans can be a lifesaver when you need quick cash. They are designed to help you cover unexpected expenses, like car repairs or medical bills. Understanding how to apply for these loans is crucial, especially when time is of the essence. Let’s dive into what you need to know about online payday loans.

What Are Online Payday Loans?

Online payday loans are short-term loans that you can apply for online. They usually have higher interest rates but are accessible to many people. Here’s why they matter:

- Quick Access: You can get cash in your account within a day.

- Easy Application: The process is simple and can be done from home.

- No Credit Checks: Many lenders don’t require a credit check, making it easier for those with poor credit to qualify.

How to Apply for Online Payday Loans

Applying for online payday loans is straightforward. Here’s a step-by-step guide:

- Research Lenders: Look for reputable lenders with good reviews.

- Gather Documents: You’ll typically need proof of income and identification.

- Fill Out the Application: Complete the online form with your details.

- Review Terms: Make sure you understand the loan terms before agreeing.

- Receive Funds: If approved, the money will be deposited into your account quickly.

By following these steps, you can secure the fast cash you need without unnecessary stress.

LeandersCashLoan – Simple, Fast Loan Approval!

How to Apply for Online Payday Loans: A Step-by-Step Guide

Applying for Online Payday Loans can be a quick solution when you need cash fast. Understanding the process is essential, as it can help you avoid confusion and make informed decisions. Let’s break it down step-by-step so you can get the funds you need without any hassle.

Step 1: Research Lenders

Before applying, take some time to research different lenders. Look for those that offer Online Payday Loans with good reviews. Check their interest rates and repayment terms. This will help you find the best option that suits your needs.

Step 2: Gather Your Information

Next, gather the necessary information. Most lenders will ask for:

- Your name and address

- Employment details

- Bank account information

Having these ready will speed up the application process.

Step 3: Complete the Application

Now, it’s time to fill out the application form. This is usually done online and is quite simple. Just follow the prompts and provide accurate information. Double-check everything before submitting to avoid delays.

Step 4: Review the Terms

After submitting, the lender will review your application. If approved, carefully read the loan terms. Make sure you understand the interest rates and repayment schedule before accepting the loan. This step is crucial to avoid surprises later on!

Step 5: Receive Your Funds

Once you accept the terms, the lender will deposit the money into your bank account. This can happen as quickly as the same day! Now you can use your Online Payday Loan to cover your expenses.

LeandersCashLoan: Fast Funds, No Hidden Fees – Apply Today!

The Benefits of Choosing Online Payday Loans for Quick Cash

When unexpected expenses pop up, finding quick cash can feel overwhelming. That’s where Online Payday Loans come in. They offer a fast and convenient way to get the money you need without the hassle of traditional loans. Let’s explore why these loans are a popular choice for many.

Speed and Convenience

Online Payday Loans are designed for speed. You can apply from the comfort of your home, often in just a few minutes. This means no long lines or waiting periods. Just fill out a simple application, and you could have cash in your account by the next business day!

Easy Application Process

The application process is straightforward. Here’s what you typically need:

- A valid ID

- Proof of income

- A bank account

This simplicity makes Online Payday Loans accessible to many people, even those with less-than-perfect credit.

Flexibility

Another great benefit is flexibility. Online Payday Loans can help cover various expenses, from medical bills to car repairs. You can use the funds for whatever urgent need arises, giving you peace of mind during tough times.

In conclusion, Online Payday Loans provide a quick, easy, and flexible solution for those in need of fast cash. They can be a lifesaver when unexpected expenses arise, helping you get back on track without unnecessary stress.

Are Online Payday Loans Right for You? Key Considerations

When unexpected expenses arise, many people consider Online Payday Loans as a quick solution. These loans can provide fast cash, but are they the right choice for you? Understanding key considerations can help you make an informed decision that suits your financial needs.

Before applying, think about these important factors:

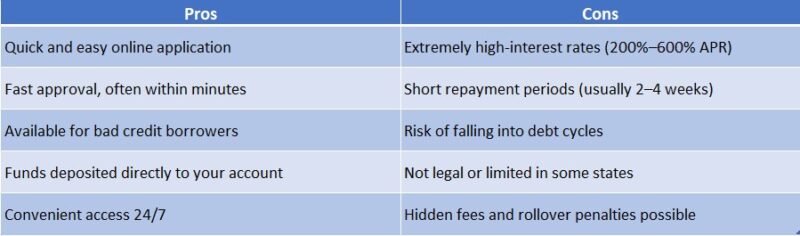

- Interest Rates: Online Payday Loans often have high interest rates. Understand how much you’ll owe in total.

- Repayment Terms: Check how long you have to repay the loan. Short terms can lead to financial strain if unprepared.

- Your Financial Situation: Assess if you can afford to pay back the loan on time.

If Online Payday Loans seem risky, consider alternatives:

- Personal Loans: Usually have lower interest rates.

- Credit Cards: Can provide a buffer for emergencies.

- Payment Plans: Some businesses offer flexible payment options.

Tips for a Smooth Application

To ease your application process, keep these tips in mind:

- Gather Documentation: Have your ID and proof of income ready.

- Read the Fine Print: Understand all terms before signing.

- Check Reviews: Research lenders to find reputable options.

In summary, Online Payday Loans can be a quick fix for urgent cash needs, but they come with risks. Evaluate your situation carefully and consider alternatives to ensure you make the best financial choice.

Comparing Online Payday Loans: Finding the Best Rates and Terms

When you’re in a pinch and need quick cash, understanding how to compare Online Payday Loans can make all the difference. These loans can help you cover unexpected expenses, but not all loans are created equal. Finding the best rates and terms is crucial to ensure you don’t end up in a cycle of debt.

Know What You Need

Before diving into the world of Online Payday Loans, it’s important to know how much money you need. This helps you narrow down your options and find a loan that fits your budget.

Shop Around for Rates

Not every lender offers the same rates. Here are some tips to find the best deals:

- Compare multiple lenders: Check at least three different websites.

- Look for hidden fees: Some loans may have extra costs that can add up.

- Read reviews: See what other borrowers have to say about their experiences.

Understand the Terms

Make sure you fully understand the terms of the loan before signing anything. Key points to consider include:

- Repayment period: How long do you have to pay it back?

- Interest rates: What will you actually pay in the end?

- Loan amounts: How much can you borrow?

By taking the time to compare Online Payday Loans, you can find the best option that meets your needs without breaking the bank. Remember, it’s all about making informed choices!

How LendersCashLoan.com Can Simplify Your Online Payday Loan Experience

When unexpected expenses arise, Online Payday Loans can provide quick cash solutions. However, the application process can often feel daunting. That’s where LendersCashLoan.com steps in, simplifying the experience for everyone.

How LendersCashLoan.com Can Help You

At LendersCashLoan.com, we know that time is crucial. Here’s how we make your Online Payday Loan experience easier:

- Easy Application Process: Our platform is user-friendly, allowing you to apply in just minutes without complicated forms.

- Fast Approval: After submitting your application, we work swiftly to get you approved, so you won’t be left waiting for days.

- Transparent Terms: We prioritize clear communication, ensuring you know what to expect with no hidden fees.

By choosing LendersCashLoan.com, you’re not just getting a loan; you’re gaining a supportive partner in your financial journey. We guide you every step of the way, helping you feel confident and informed.

Why Choose Online Payday Loans?

Online Payday Loans are a fast and convenient way to access cash for unexpected bills or emergencies without the hassle of traditional loans.

Benefits of Using LendersCashLoan.com

- 24/7 Access: Apply anytime, anywhere with our round-the-clock online platform.

- Secure Transactions: Your information is safe with us; we prioritize your privacy.

- Flexible Repayment Options: Choose a repayment plan that suits your needs, making it easier to manage your finances.

Common Myths About Online Payday Loans Debunked

When it comes to Online Payday Loans, many people have misconceptions that can lead to confusion. Understanding how to apply for fast cash is essential, especially when unexpected expenses arise. Let’s clear the air and debunk some common myths surrounding these loans.

Myth 1: Online Payday Loans Are Only for Emergencies

Some believe that Online Payday Loans should only be used in dire situations. While they are great for emergencies, they can also help with planned expenses, like car repairs or medical bills. It’s all about using them wisely!

Myth 2: The Application Process Is Complicated

Many think applying for Online Payday Loans is a lengthy and complicated process. In reality, it’s quite simple! Most lenders offer an easy online application that takes just a few minutes to complete. You can get cash in your account quickly, often within the same day!

Myth 3: You Need Perfect Credit to Qualify

Another common myth is that only those with perfect credit can get Online Payday Loans. This isn’t true! Many lenders consider your overall financial situation, not just your credit score. So, even if your credit isn’t great, you might still qualify! By debunking these myths, we can see that Online Payday Loans can be a helpful tool when used responsibly. Always remember to read the terms and understand the costs involved before applying.

FAQs

🌐 What are online payday loans?

Online payday loans are short-term loans you can apply for over the internet, typically offering fast approval and funding within 24 hours.

🕒 How quickly can I get an online payday loan?

Many lenders offer same-day or next-business-day funding, especially if you apply early and meet all requirements.

📱 What do I need to apply online?

You’ll usually need a valid ID, proof of income, contact details, and a checking account (or alternative payout method).

🔒 Is it safe to apply for a payday loan online?

Yes—if you use a reputable, encrypted lender site. Always check for licenses, customer reviews, and privacy policies.

💵 How do I repay an online payday loan?

Repayment is often automatic—lenders will deduct the amount from your bank account or prepaid card on the due date.

LeandersCashLoan: Apply Now for Same-Day Cash!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Loan!

"*" indicates required fields