Online Payday Loans in Virginia: Quick Approval Options

When unexpected expenses pop up, many people in Virginia turn to online payday loans for quick cash. These loans can be a lifesaver, especially when you need money fast. Understanding how they work is crucial to making informed decisions about your finances.

What Are Online Payday Loans?

Online payday loans in Virginia are short-term loans designed to help you cover urgent expenses until your next paycheck. They’re typically easy to apply for and can provide quick approval, making them a popular choice for many.

Benefits of Online Payday Loans

- Fast Approval: Many lenders offer instant decisions, so you can get cash quickly.

- Convenience: Apply from the comfort of your home without the need to visit a bank.

- Flexible Amounts: Borrow what you need, usually between $100 and $1,000.

Things to Consider

While online payday loans can be helpful, it’s important to borrow responsibly. Make sure to read the terms carefully and understand the repayment process. This way, you can avoid falling into a cycle of debt.

LeandersCashLoan – Simple, Fast Loan Approval!

How to Get Quick Approval for Online Payday Loans in Virginia

Getting quick approval for online payday loans in Virginia can be a lifesaver when unexpected expenses arise. These loans offer a fast solution for those who need cash urgently. Understanding how to navigate the application process is key to securing the funds you need without unnecessary delays.

Steps to Get Quick Approval

- Research Lenders: Start by looking for reputable lenders that offer online payday loans in Virginia. Check reviews and ratings to ensure they are trustworthy.

- Gather Required Documents: Most lenders will ask for basic information like your ID, proof of income, and bank details. Having these ready can speed up the process.

- Fill Out the Application: Complete the online application form accurately. Double-check your information to avoid mistakes that could delay approval.

Benefits of Quick Approval

- Fast Access to Funds: Once approved, you can receive money in your account as soon as the next business day.

- Flexible Use: You can use the funds for any urgent need, whether it’s medical bills or car repairs.

- Convenience: Applying online means you can do it from the comfort of your home, anytime you need.

LeandersCashLoan: Fast Funds, No Hidden Fees – Apply Today!

The Benefits of Choosing Online Payday Loans in Virginia

When unexpected expenses hit, many in Virginia turn to online payday loans for quick cash. These loans provide a fast and convenient solution, often with quick approval options to help manage urgent bills.

Fast Approval Process

A key benefit of online payday loans in Virginia is their speedy approval. Unlike traditional loans that may take days or weeks, these loans can be approved in just hours, ensuring you get funds when you need them most.

Convenience at Your Fingertips

Applying for online payday loans is simple and can be done from home using your smartphone or computer. Forget about long lines and paperwork; just a few clicks can lead you to financial relief.

Flexible Repayment Options

Most lenders provide flexible repayment plans that suit your needs. This allows you to choose a schedule that works for you, making it easier to manage your finances without added stress. Additionally, many lenders offer clear terms, so you know what to expect.

Are Online Payday Loans in Virginia Right for You?

When unexpected expenses arise, many people in Virginia find themselves considering online payday loans. These loans offer quick approval options, making them an attractive choice for those in need of immediate cash. But are they the right fit for you? Let’s explore!

Understanding Online Payday Loans in Virginia

Online payday loans in Virginia are short-term loans designed to help you cover urgent expenses. They are typically easy to apply for and can provide funds quickly, often within a day. However, it’s essential to understand the terms and conditions before diving in.

Key Benefits of Online Payday Loans

- Fast Approval: Many lenders offer quick decisions, sometimes in minutes.

- Convenience: Apply from the comfort of your home, anytime.

- Flexible Amounts: Borrow what you need, usually between $100 and $1,000.

Before you decide, weigh these benefits against potential drawbacks, like high-interest rates. Always read the fine print to ensure you make an informed choice.

Key Requirements for Securing Online Payday Loans in Virginia

When unexpected expenses arise, many people in Virginia turn to online payday loans for quick financial relief. These loans offer fast approval options, making them an attractive choice for those in need of immediate cash. Understanding the key requirements can help you navigate this process smoothly.

To qualify for online payday loans in Virginia, there are a few essential criteria you need to meet. Here’s a quick rundown:

- Age: You must be at least 18 years old.

- Income: A steady source of income is crucial. Lenders want to ensure you can repay the loan.

- Bank Account: A valid checking account is necessary for the loan deposit and repayment.

By meeting these requirements, you can increase your chances of securing online payday loans in Virginia quickly. Remember, the process is designed to be straightforward, so don’t hesitate to reach out to lenders if you have questions. They’re there to help you get the funds you need!

Comparing Online Payday Loans in Virginia: Lenders and Rates

When unexpected expenses arise, many people in Virginia turn to online payday loans for quick financial relief. These loans offer fast approval options, making them a popular choice for those in need of immediate cash. Understanding the landscape of online payday loans in Virginia can help you make informed decisions.

Key Factors to Consider

- Lender Reputation: Always check reviews and ratings to ensure you’re dealing with a trustworthy lender.

- Interest Rates: Compare rates among different lenders to find the best deal.

- Loan Amounts: Some lenders offer higher amounts, which can be beneficial depending on your needs.

- Repayment Terms: Look for flexible repayment options that fit your budget.

By comparing these factors, you can find the right online payday loans in Virginia that suit your financial situation. Remember, it’s essential to read the fine print and understand all terms before committing. This way, you can avoid surprises and make the most of your loan.

Tips for a Smooth Application Process for Online Payday Loans in Virginia

When life throws unexpected expenses your way, online payday loans in Virginia can be a quick solution. These loans offer fast approval options, making them a popular choice for those in need of immediate cash. But how can you ensure a smooth application process? Let’s explore some helpful tips!

Gather Your Information First

Before applying for online payday loans, gather all necessary documents. This includes your ID, proof of income, and bank account details. Having everything ready will speed up the process and help you avoid delays.

Check Your Eligibility

Make sure you meet the eligibility requirements for online payday loans in Virginia. Most lenders require you to be at least 18 years old, a resident of Virginia, and have a steady income. Knowing this beforehand can save you time and effort!

Read the Terms Carefully

Always read the loan terms before signing anything. Understanding the interest rates and repayment schedule is crucial. This way, you won’t be surprised by hidden fees later on. Remember, being informed is key to a smooth experience!

How ‘LendersCashLoan.com’ Can Help You Find the Best Online Payday Loans in Virginia

Finding the right financial help can be tough, especially when unexpected expenses pop up. That’s where online payday loans in Virginia come into play. They offer quick approval options, making it easier for you to get the cash you need without the long wait times of traditional loans.

At ‘LendersCashLoan.com’, we understand that time is of the essence. Our platform connects you with lenders who specialize in online payday loans. This means you can find options that suit your needs without the hassle of endless searching.

Why Choose Online Payday Loans?

- Fast Approval: Many lenders provide instant decisions.

- Convenience: Apply from the comfort of your home.

- Flexible Amounts: Borrow what you need, when you need it.

With our help, you can navigate the world of online payday loans easily, ensuring you make informed choices that fit your financial situation.

Common Misconceptions About Online Payday Loans in Virginia

When it comes to managing finances, many people in Virginia find themselves in need of quick cash. Online payday loans in Virginia offer a fast solution for those unexpected expenses. However, there are several misconceptions that can cloud judgment about these loans. Let’s clear the air!

Misconception 1: They’re Always a Bad Idea

Many believe that online payday loans are a trap. While they can be risky if mismanaged, they can also provide a lifeline in emergencies. It’s crucial to understand the terms and use them wisely.

Misconception 2: Approval is Impossible

Some think that getting approved for online payday loans is nearly impossible. In reality, many lenders offer quick approval options, making it easier for borrowers to access funds when they need them most. Just ensure you meet the basic requirements!

Misconception 3: High Fees are Inevitable

Another common belief is that all online payday loans come with exorbitant fees. While some lenders may charge high rates, many offer competitive terms. Always shop around and read the fine print to find the best deal for your situation.

FAQs

💻 Are online payday loans available in Virginia?

Yes, many licensed lenders offer online payday loans in Virginia, ensuring quick access to funds while adhering to state regulations.

📋 What are the eligibility requirements in Virginia?

Typically, you must be at least 18 years old, provide a valid government-issued ID, have a steady source of income, and an active bank account for fund disbursement.

⏱️ How fast can I receive funds from an online payday loan?

Many lenders process applications quickly, with funds often deposited the same day or by the next business day once approved.

💰 What loan amounts are generally available in Virginia?

Loan amounts usually range from around $100 to $1,000, depending on your income and the lender’s policies.

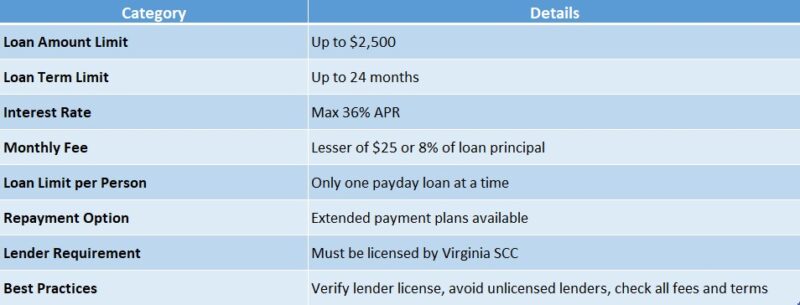

⚖️ Are online payday loans regulated in Virginia?

Yes, lenders must comply with Virginia’s lending laws and consumer protection regulations, so always verify that the lender is licensed and follows state guidelines.

LeandersCashLoan: Apply Now for Same-Day Cash!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Loan!

"*" indicates required fields