Temporary Cash Solutions: A Guide for Urgent Home Needs

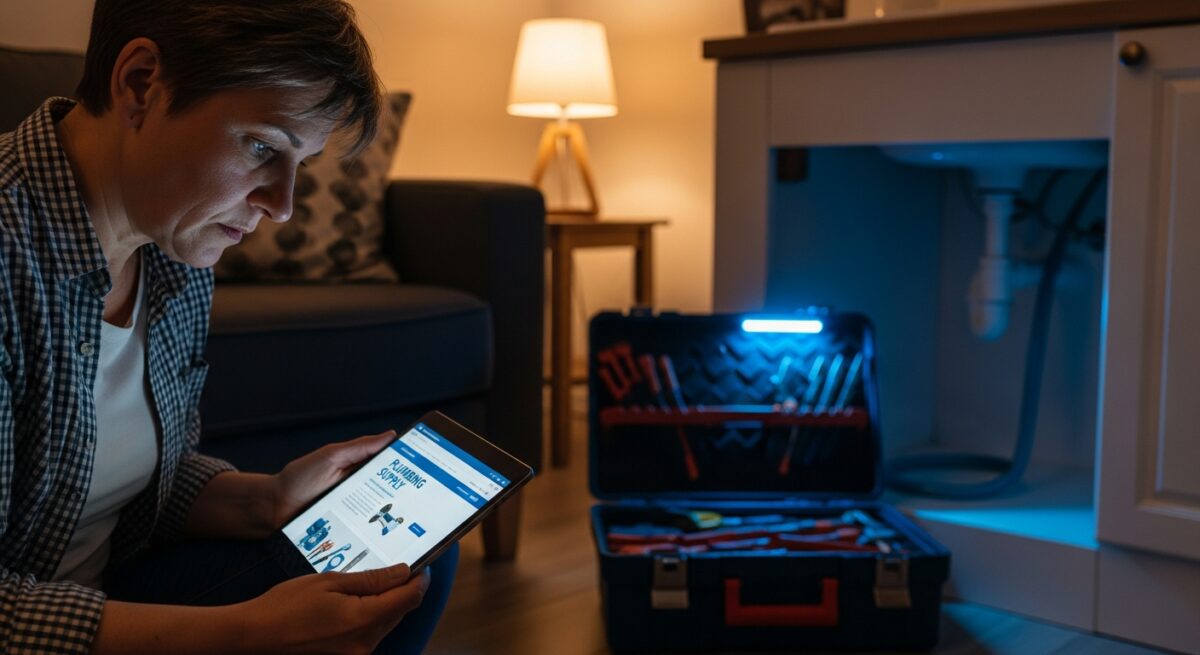

Owning a home means being prepared for the unexpected. Whether it’s a sudden plumbing disaster, a broken furnace in winter, or an urgent roof repair after a storm, these emergencies demand immediate attention—and often, immediate funds. When your savings are a bit short and payday is still a week away, knowing your options for temporary cash solutions can be the difference between a minor hiccup and a major, costly headache.

Understanding Temporary Cash Solutions

Temporary cash solutions are short-term financial tools designed to bridge a gap between an urgent expense and your next source of income. Think of them like a financial patch for your home’s budget—a way to address a pressing need quickly, with the understanding you’ll repay the amount in a short period.

For homeowners, these are not meant for long-term financing or large projects, but for managing unforeseen costs that can’t wait. The goal is to access funds swiftly to restore safety, comfort, and function to your home without derailing your entire financial plan.

How They Differ From Traditional Loans

Unlike a mortgage or a car loan, temporary solutions like payday advances or short-term installment loans are typically for smaller amounts and have much shorter repayment terms, often aligning with your next paycheck. The application process is usually faster, with less emphasis on lengthy credit checks and more on your current ability to repay.

Why It Matters for Homeowners

When a home system fails, time is of the essence. A small leak can lead to major water damage, and a malfunctioning electrical issue can be a safety hazard. Temporary cash solutions provide the speed needed to hire a professional repairman right away, preventing a minor issue from escalating into a catastrophic, wallet-draining problem.

The benefit is clear: you protect your largest investment—your home. By accessing funds quickly, you maintain your home’s integrity, ensure your family’s comfort and safety, and avoid the higher costs associated with delayed repairs. It’s a strategic move for responsible homeowners facing a timing crunch with their finances.

Don’t let a financial delay turn a small repair into a major renovation. Explore your options for a fast, responsible solution today. Find trusted cash services near you or call (555) 123-4567 to speak with a specialist.

Common Issues and Their Causes

Home emergencies that often require quick cash aren’t random; they usually stem from wear and tear, sudden failures, or extreme weather. Understanding these common triggers can help you anticipate needs, but when they strike unexpectedly, you need a plan.

The root cause of needing a temporary cash solution is often a mismatch in timing. Your emergency fund might be low, an expensive car repair might have just tapped you out, or multiple bills might have hit at once. Life’s financial rhythm doesn’t always sync with your home’s maintenance needs.

- System Failures: HVAC breakdowns, water heater leaks, or electrical shorts.

- Weather Damage: Fallen trees, roof leaks from a storm, or burst pipes from a freeze.

- Appliance Breakdowns: A refrigerator or washing machine failing suddenly.

- Essential Repairs: A broken window, faulty lock, or other urgent safety/security issue.

How Professionals Can Help You Access Solutions

Just as you’d call a professional for a home repair, working with a reputable financial service provider ensures you navigate temporary cash options safely and effectively. They guide you through the process with clarity, helping you understand the terms, fees, and repayment schedule before you commit.

The process is typically straightforward. You provide basic information about your income and banking, the provider reviews your application quickly, and if approved, funds can often be available in as little as one business day. This streamlined approach is designed for urgency, similar to how a repairman diagnoses and quotes a job efficiently. For example, services like completing a Cash 1 online application are built for this kind of speed and convenience.

Ready to address your home’s urgent need? A simple application can start the process. Learn how to get a fast cash advance online or call (555) 123-4567 now.

Signs You Should Not Ignore

Some home issues give you warning signs before they become full-blown emergencies. Financially, the signs that you might need to consider a temporary cash solution are just as important to recognize. Being proactive on both fronts saves money and stress.

Ignoring a flickering light or a slow drain can lead to bigger problems. Similarly, ignoring the signs of a cash shortfall for an urgent repair can force you into more expensive, less ideal options later. It’s about responsible home stewardship.

- You have a verified, urgent home repair quote from a trusted professional.

- Your savings won’t cover the cost without jeopardizing other critical bills.

- The problem poses a clear risk to safety, security, or could cause escalating damage.

- Your next paycheck will cover the repayment, but the repair can’t wait until then.

Cost Factors and What Affects Pricing

The cost of a temporary cash solution isn’t just the amount you borrow; it includes fees and interest. These are influenced by several straightforward factors, much like how a repair bill depends on parts, labor, and urgency.

The principal amount you need, the lender’s specific fee structure, the term length of the loan, and your state’s regulations all play a role. Reputable providers will disclose all costs transparently upfront, so you know exactly what you’re agreeing to, with no surprises. It’s always wise to review the terms carefully, just as you would a contractor’s estimate.

Understanding the cost upfront is key to a smart decision. Our team is here to explain everything clearly. For existing customers, you can access your CashNGo login account to manage your details, or call (555) 123-4567 to discuss your situation.

How To Choose the Right Professional or Service

Selecting a provider for a temporary cash solution requires the same diligence as hiring a contractor. You want someone reputable, transparent, and licensed to operate in your state. Look for clear terms, positive customer reviews, and responsive customer service.

Check for a physical address and phone number, read the fine print on fees and APRs, and ensure you understand the repayment process. A trustworthy provider will answer all your questions patiently and won’t pressure you. They are there to provide a service that helps you solve a problem, responsibly.

Long-Term Benefits for Your Home

Using a short-term financial tool for an urgent repair is an investment in your home’s long-term health. By acting quickly, you preserve your property’s value, prevent secondary damage that is far more expensive to fix, and maintain a safe, comfortable living environment for your family.

This proactive approach saves you significant money over time. It also provides peace of mind, knowing you have a practical strategy for handling life’s unexpected turns without jeopardizing the well-being of your most valuable asset.

Frequently Asked Questions

What is the fastest way to get a temporary cash solution?

Online applications with direct deposit are often the fastest. Many reputable services can provide approval decisions quickly and deposit funds into your account as soon as the next business day after approval.

Will using this affect my credit score?

Many short-term lenders focus on your income and banking history rather than a traditional credit check for approval. However, repayment activity may be reported to credit bureaus. Always confirm the lender’s policy beforehand.

How much can I typically get with a short-term solution?

Amounts vary by state law and provider, but they are generally designed for smaller, urgent needs—often ranging from a few hundred to a few thousand dollars, sufficient to cover common home repairs.

What if I can’t repay on the due date?

Contact your lender immediately. Many offer options like payment plans or extensions. It’s crucial to communicate proactively, as late fees can add up and affect future borrowing ability.

Are there alternatives to payday loans for emergency cash?

Yes. Some alternatives include short-term installment loans, which allow repayment over a few payments, or exploring specific loan products like a Bison Cash Loan which may offer different structures. Always compare terms.

What do I need to apply?

Typically, you’ll need a government-issued ID, proof of steady income (like recent pay stubs), an active checking account, and a valid phone number. The process is designed to be simple and document-light.

Facing a home repair emergency doesn’t have to mean financial panic. By understanding your options for temporary cash solutions and working with professional, transparent providers, you can navigate these unexpected moments with confidence. The right short-term financial tool, used responsibly, is simply another part of smart homeownership—allowing you to fix what’s broken quickly and get back to enjoying your home.

Find a Loan!

"*" indicates required fields